In late October, the Social Security Administration announced that there will be no Cost of Living Adjustment for Social Security benefits, a decision that marks just the third time since 1972 that SS checks (and a number of other benefit programs that use the SS benefit amount to determine their benefit amounts) will not see a COLA increase in the new year despite the fact that their expenses – their actual cost of living – has increased. This largely because the formula used to determine the rate of inflation is based on a metric that favors younger Americans and doesn’t properly weight expenses for especially vulnerable populations, including seniors, children and low income families and adults. An article in The Nation explains:

In late October, the Social Security Administration announced that there will be no Cost of Living Adjustment for Social Security benefits, a decision that marks just the third time since 1972 that SS checks (and a number of other benefit programs that use the SS benefit amount to determine their benefit amounts) will not see a COLA increase in the new year despite the fact that their expenses – their actual cost of living – has increased. This largely because the formula used to determine the rate of inflation is based on a metric that favors younger Americans and doesn’t properly weight expenses for especially vulnerable populations, including seniors, children and low income families and adults. An article in The Nation explains:

They aren’t getting a cost-of-living adjustment because there was actually a 0.4 percent decrease in the government’s calculation of the cost of living from the third quarter of 2014 to the third quarter of 2015. The government uses a formula called the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) to calculate Social Security benefits, and that index revealed a slight decrease in the cost of living, primarily because gasoline prices fell sharply in the past year.

This is where advocates for seniors call foul: A drop in gasoline prices largely benefits younger Americans, while seniors, who already pay twice the medical costs as the average American, saw inflation in healthcare prices along with traditional outlays like food and housing. In other words, an elderly grandmother who no longer drives but has seen her prescription prices go up is effectively being told by the government her benefit check won’t get a cost-of-living bump because gasoline is cheaper.

Many economists and advocates have called on the government to use a different price index for Social Security benefits that more accurately measures the cost of living for elderly Americans—the Bureau of Labor Statistics actually already tabulates this, called the CPI-E, in a strictly “experimental” mode, but doesn’t apply it. That formula showed a 0.6 percent increase in the cost of living over the last year, and elsewhere, core goods and services are up 2 percent.

In other words, seniors who rely on SS for most or all of their income, as well as those who receive other benefits based on SS benefits, will see the real buying power of their already meager checks (the average SS benefit for a single adult is just about $15,000 a year) decline by up to 2%. That may not sound like much, but it breaks down to a loss of $25 in buying power per month. If you break that out further using the SNAP formula of $2.21 per person per meal, that’s the equivalent of losing 11 meals per month.

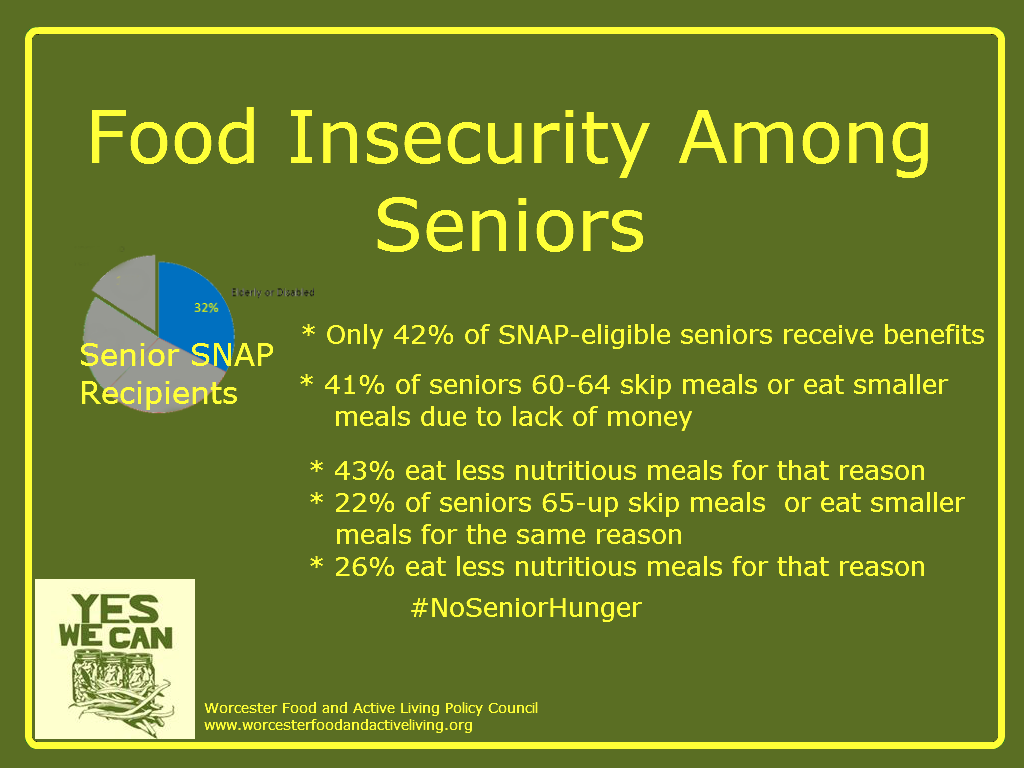

That loss eats into already stretched food budgets for seniors who are already over-represented among those who are food insecure. According to numbers provided by the Intergenerational Urban Institute at Worcester State University, the number of seniors who reported being food insecure increased by 56% between 2007 and 2013, making them one of the populations hardest hit by the recent recession. Other facts about seniors and food insecurity include:

- In 2014, using the Supplemental Poverty Measure, seniors make up 14% of people living in poverty.

- 41% of seniors age 60-64 skip or eat smaller meals due to lack of money

- 43% of seniors age 60-64 eat less nutritious meals due to lack of money

- 22% of seniors 65 and older skip or eat smaller meals due to lack of money

- 26% of seniors 65 and older eat less nutritious meals due to lack of money

- 7 million seniors annually seek help from food banks in the Feeding America network

The results of food insecurity for seniors run far deeper than a grumbling tummy. Research shows that seniors who report food insecurity are:

- 50% more likely to have diabetes

- Twice as likely to report fair or poor general health

- 3 times more likely to suffer from depression

- 14% more likely to have high blood pressure

- Nearly 60% more likely to have a heart attack or suffer from congestive heart failure

SNAP benefits can provide a necessary and vital buffer for seniors at risk of food insecurity and hunger, but many of those eligible don’t participate in the program. In fact, only 42% of SNAP-eligible seniors actually receive benefits. Of those who qualify, 3 in 5 do not participate. There are a variety of reasons for this, ranging from not knowing that they qualify to being embarrassed to apply for “charity.” Some basic policy measures could help increase senior participation in SNAP, which would benefit not only those seniors, but the community as a whole. Those measures include:

- Medical providers screen for food security at appointments, similar to the food insecurity screening used to identify families with children at risk of food insecurity

- Provide tax preparation professionals with information about SNAP eligibility (ed. note – My parents learned they qualified when their long-time accountant told them they would qualify.)

- Distribute information about SNAP with SS allotment/determination letters

- Expand/adapt outreach efforts aimed at reaching families with young children to include families with seniors

- Change the measure used to calculate the COLA for SS to one more relevant to seniors

Our seniors are among our most valuable resources – and our most endangered populations. No senior should ever go hungry, and if we make the right decisions now, we can make sure that every senior among us has access to adequate, nutritious, healthy food.